|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

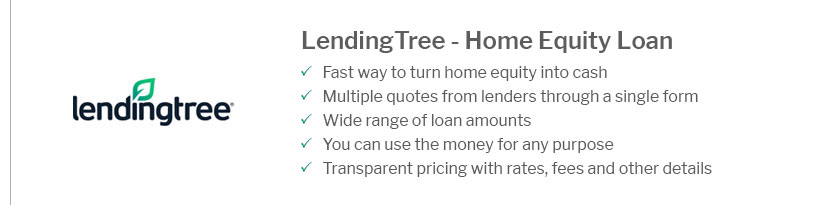

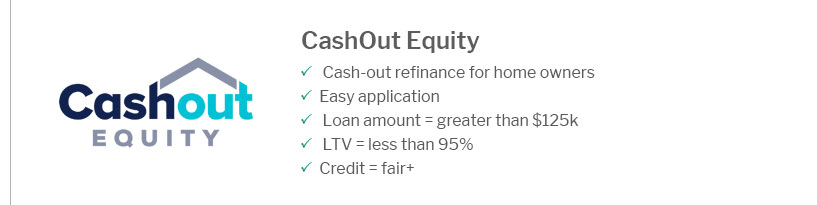

Understanding Refinance Interest Rates in California for Informed Decision-MakingRefinancing your mortgage can be a strategic move to lower your interest rate, reduce monthly payments, or access home equity. In California, a state with a dynamic real estate market, understanding refinance interest rates is crucial. Factors Influencing Refinance Interest RatesVarious factors impact the interest rates for refinancing in California. Knowing these can help you secure the best possible rate. Credit ScoreYour credit score plays a significant role in determining your refinance interest rate. Higher scores often qualify for lower rates. Loan Amount and Home EquityRefinance rates may vary based on your loan amount and the equity you have in your home. More equity often results in better terms. Types of Refinance OptionsUnderstanding the different types of refinance options available can help you choose what best suits your financial goals. Rate-and-Term RefinanceThis is the most common refinance option, allowing homeowners to change their interest rate and loan term without altering the principal amount. Cash-Out RefinanceA cash-out refinance replaces your current mortgage with a new one for more than you owe, allowing you to take the difference in cash. This can be beneficial if you want to refinance harp twice to improve your financial situation.

Steps to Refinance Your Mortgage in California

FAQs About Refinance Interest Rates in CaliforniaWhat is the current average refinance interest rate in California?The average refinance interest rate in California fluctuates based on the market and economic conditions. It's advisable to check with local lenders for the most accurate rates. How can I qualify for the lowest refinance rates?To qualify for the lowest rates, maintain a high credit score, increase your home equity, and reduce your debt-to-income ratio. Are there any fees associated with refinancing?Yes, refinancing typically involves fees such as application fees, appraisal fees, and closing costs. These can often be rolled into the new loan. Understanding these facets of refinance interest rates in California can empower homeowners to make informed decisions, optimize their mortgage terms, and enhance their financial health. https://www.zillow.com/mortgage-rates/ca/

Answer a few questions about your loan preferences to compare mortgage rates from multiple lenders in California. https://www.usbank.com/home-loans/mortgage/mortgage-rates/california.html

Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. https://www.calcoastcu.org/mortgage-rates/

Conforming Fixed-Rate Mortgages ; 10-year Fixed - TermBuster, 5.875%, 5.876% ; 15-year Fixed, 5.875%, 6.059% ; 20-year Fixed, 6.375%, 6.509% ; 30-year Fixed, 6.625% ...

|

|---|